Feie Calculator for Beginners

The Ultimate Guide To Feie Calculator

Table of Contents6 Easy Facts About Feie Calculator ExplainedNot known Incorrect Statements About Feie Calculator Excitement About Feie CalculatorFeie Calculator Fundamentals ExplainedThe Definitive Guide for Feie Calculator

He sold his United state home to establish his intent to live abroad completely and used for a Mexican residency visa with his spouse to help accomplish the Bona Fide Residency Examination. Neil points out that getting residential property abroad can be testing without very first experiencing the location."We'll absolutely be outdoors of that. Also if we come back to the US for medical professional's consultations or organization telephone calls, I doubt we'll spend even more than one month in the US in any kind of provided 12-month period." Neil highlights the relevance of strict monitoring of U.S. brows through (Taxes for American Expats). "It's something that individuals require to be really thorough regarding," he says, and advises expats to be careful of typical mistakes, such as overstaying in the united state

Feie Calculator Fundamentals Explained

tax obligations. "The reason why U.S. tax on around the world earnings is such a large offer is due to the fact that many individuals forget they're still based on united state tax obligation even after relocating." The united state is among the couple of nations that tax obligations its citizens no matter where they live, meaning that also if an expat has no revenue from U.S.

tax return. "The Foreign Tax obligation Credit history permits individuals operating in high-tax nations like the UK to counter their united state tax obligation by the amount they've already paid in tax obligations abroad," says Lewis. This makes sure that expats are not exhausted twice on the same revenue. However, those in low- or no-tax nations, such as the UAE or Singapore, face added difficulties.

All about Feie Calculator

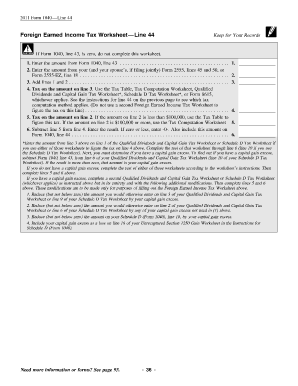

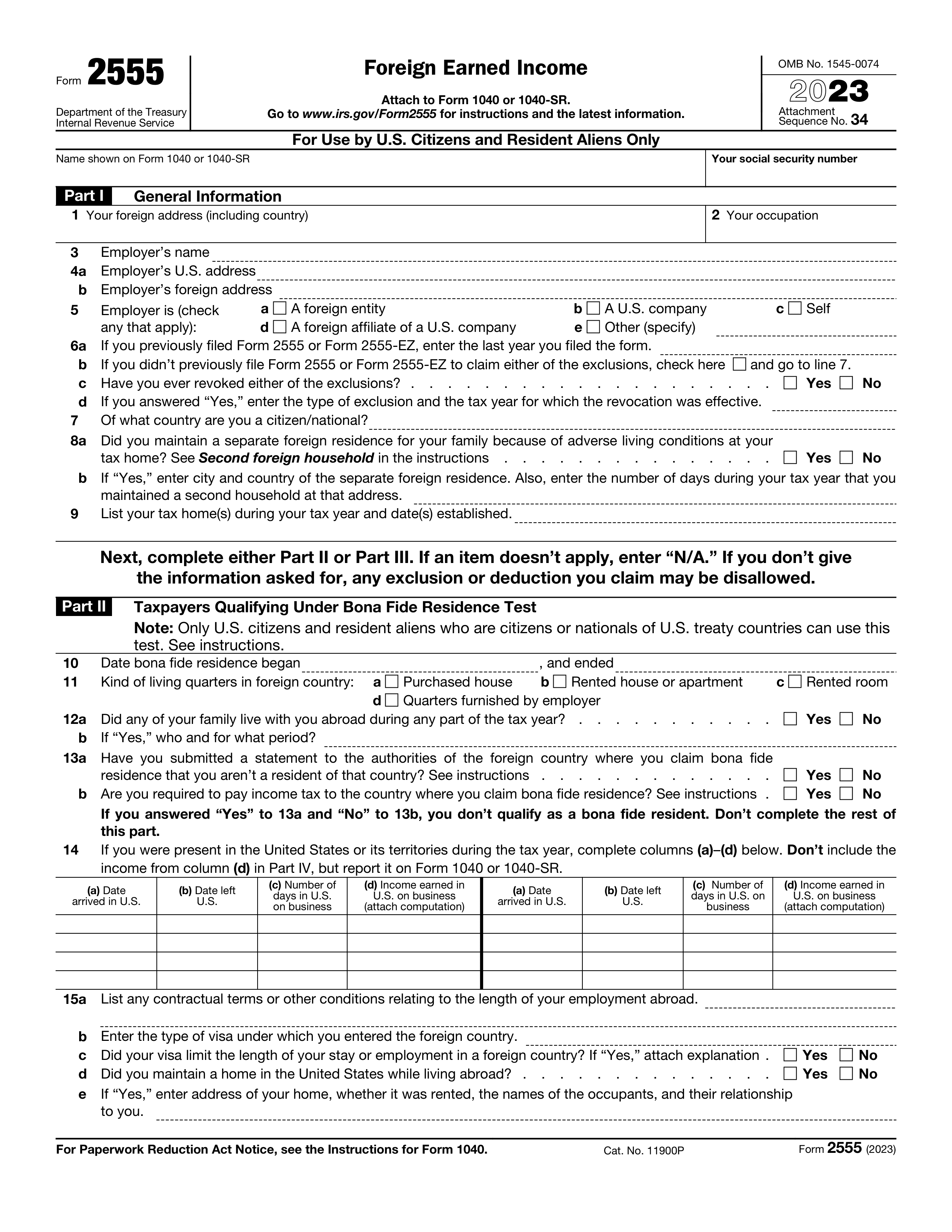

Below are some of the most frequently asked questions about the FEIE and various other exemptions The International Earned Earnings Exclusion (FEIE) enables united state taxpayers to leave out up to $130,000 of foreign-earned earnings from government revenue tax, reducing their united state tax obligation. To get approved for FEIE, you have to fulfill either the Physical Visibility Test (330 days abroad) or the Authentic House Test (prove your primary residence in an international nation for an entire tax obligation year).

The Physical Presence Examination additionally requires U.S (Form 2555). taxpayers to have both a foreign revenue and an international tax obligation home.

Some Known Factual Statements About Feie Calculator

An income tax obligation treaty between the U.S. and one more country can help avoid double tax. While the Foreign Earned Income Exclusion lowers taxed income, a treaty may provide additional advantages for qualified taxpayers abroad. FBAR (Foreign Savings Account Record) is a required filing for U.S. citizens with over $10,000 in international monetary accounts.

Eligibility for FEIE relies on conference particular residency or physical presence examinations. is a tax expert on the Harness platform and the founder of Chessis Tax. He is a participant of the National Organization of Enrolled Representatives, the Texas Society of Enrolled Brokers, and the Texas Society of CPAs. He brings over a years of experience benefiting Huge 4 companies, advising expatriates and high-net-worth people.

Neil Johnson, CPA, is a tax consultant on the Harness platform and the creator of The Tax Dude. He has over thirty years of experience and now concentrates on CFO solutions, equity settlement, copyright taxes, cannabis tax and separation related tax/financial planning issues. He is a deportee based in Mexico - https://www.edocr.com/v/baoqoy8v/feiecalcu/feie-calculator.

The international gained income exclusions, sometimes referred to as the Sec. 911 exclusions, omit tax on wages earned from you could try this out functioning abroad. The exemptions consist of 2 components - an income exemption and a real estate exclusion. The complying with Frequently asked questions review the advantage of the exclusions consisting of when both partners are expats in a general manner.

The Main Principles Of Feie Calculator

The income exclusion is currently indexed for rising cost of living. The maximum annual revenue exemption is $130,000 for 2025. The tax obligation benefit excludes the earnings from tax obligation at lower tax obligation rates. Formerly, the exemptions "came off the top" lowering revenue topic to tax at the top tax obligation rates. The exemptions may or may not decrease income made use of for various other objectives, such as individual retirement account limits, child credit ratings, individual exemptions, and so on.

These exemptions do not exempt the salaries from United States taxation however merely supply a tax decrease. Keep in mind that a bachelor working abroad for every one of 2025 who made concerning $145,000 without various other revenue will have taxed income decreased to no - successfully the same answer as being "tax obligation free." The exclusions are calculated every day.